Firstly I would just want to say that, I understand that these are uncharted times—both as professionals and as individuals. Wigzo is here to support you and to keep your business growing—no matter what. Please do not hesitate to reach out to us for additional information or questions.

During the writing of this blog, the Coronavirus has already claimed the lives of 95,731 people and infected around 1,603,896 people around the world.

The whole world has been shaken by this lethal monster. The economy and industries are no exception to the virus, facing massive blows as well.

The world is a very different place than it was a few weeks ago, with humanity facing an unprecedented event and grappling with its ramifications. However, COVID-19 has certainly made an impact on eCommerce over the past couple of weeks now that isolation and social distancing measures have been put in place.

Workers in many infected countries have been asked to work from home. Countries including the UK, Italy, France, and India have been placed under complete lockdown and schools have been shut down.

Unsurprisingly, many stores have since taken the decision out of consumers’ hands by shutting up shop, forcing traditional consumers to adopt eCommerce as an alternative.

This resource is intended to provide information so that you can make the best decisions for your brand during uncertain times. We’ve gathered some facts and numbers around how behaviors are changing, what products people are buying, and what industries are feeling the strain to help you determine what choices you can make for your business.

Understanding Panic Buying and Coronavirus

Humans respond to crises in different ways. We tend to do most of the things out of the defense reflex mechanism whenever put across a difficult and uncertain situation. These psychological factors are responsible for the famous term – “retail therapy” in times of personal crises; however, during a pandemic, there are added layers to it. One is that the global spread of COVID-19 has been accompanied by a lot of contradictory information.

One is that the global spread of COVID-19 has been accompanied by a lot of uncertainty and at times contradictory information. When people are hearing differing advice from multiple sources, they have a greater instinct to over-, rather than under-, prepare.

Second, there is this crowd mentality. Seeing other people stacking up their shelves resulting in a scarcity of necessary products which obviously makes everyone do the same thing.

So, are the brands adapting to these changing needs? Are they flexible enough for such times? I witnessed people responded by stocking up. They bought out medical supplies especially hand sanitizer and masks plus household essentials like toilet paper. This left both, brick-and-mortar and online stores struggling to keep up with such an instant rise in the demand, prices were to shoot up of course. Have you given a thought to the eCommerce space during all the crisis lately? eCommerce activity, especially related to health and grocery, has shown a surge all across the globe in general. According to data from eCommerce ad tech provider Pacvue, there are surges in Amazon searches for products like hand sanitizer and antibacterial soap. Digital shoppers are also willing to wait for the products that they need with longer delivery windows in order to avoid going to stores, where inventory may be limited anyway.

Is it safe to Order Online During COVID-19?

As it becomes even more clear just how infectious COVID-19 is, some shoppers have raised questions about the safety of receiving their online orders. Experts are finding that the virus can live on surfaces from three hours to up to three days, depending on the material. (Note that conclusive findings are difficult to come by in these early days of the virus, and as experts continue their study of it, these numbers may change.)

That said, it’s unlikely that COVID-19 would survive on your purchased items from the time they were packed to the time you received your package (especially with the slowdown in the delivery system). And shipping conditions make a tough environment for COVID-19 as well, so it’s not likely you’ll be exposed via the package itself, either.

Increase and decrease

At the top end, Personal Care saw a 120-130 percent increase in GMV, largely driven by the sale of sanitizers and hygiene products followed by Grocery which saw a steep increase of 110-115 percent in GMV as people started stocking up on staples and supplies in order to avoid visits to the supermarkets and local stores. E-pharma saw 50-60 percent growth led by strong growth in e-consultations and sharp demand spike for prescription medicines.

Interestingly, Home & Furniture saw a 15-20 percent increase in GMV with increasing sales of small-ticket items like home decor, linen, bed/bath accessories; Fashion saw a 30-35 percent increase as people most likely spent more time browsing apps while working from home.

While there was a general decline in demand for large ticket items in Electronics, work from home led to increased demand for laptops and smartphone accessories, resulting in a GMV increase of 20-25 percent.

In Mobility, the decline in cab services took the highest beating followed by autos from the first week itself. The bike market also started contracting this week.

After an initial spike in the first week, food delivery declined in the second week and is expected to decline further, as people stop ordering in and start cooking at home. Limited travel and work from home took down GMV of the Hotel-tech business and with restrictions on Malls/Cinema Halls, ticketing was one of the worst-hit segments of online services.

The Nudge Factor: Product Seeing a Rise in Demand

Segments across e-commerce are helping ease peoples’ anxieties by helping bring solutions both virtually also on the doorstep.

-

Edtech

Due to the closure of many schools across the globe, homeschooling and school equipment queries are seeing huge spikes in demand, good news for any retailers supplying B2C education equipment. many education technology companies have started offering free teaching resources to educators to help with the transition from in-person to online learning to help bridge the gap. They are also helping students get on their platform by providing free resources, that can be used by students to ensure they are up-to-date on their curriculum. A crucial solution to an education obsessed nation

-

Gaming and Subscription

The segment is witnessing a surge in usage considering most individuals are restricted to their homes. OTT platforms are helping users pass their time with engaging content and allowing users to binge shows on their long drawn watchlist. Streaming platforms are allowing users to stream simultaneously with friends in order to keep social engagement alive while some studios are mulling a direct to streaming option for their latest blockbusters helping to get more users onboard. On the other side.

Both Xbox and Netflix have seen notable spikes in search of interest over the past couple of weeks.

-

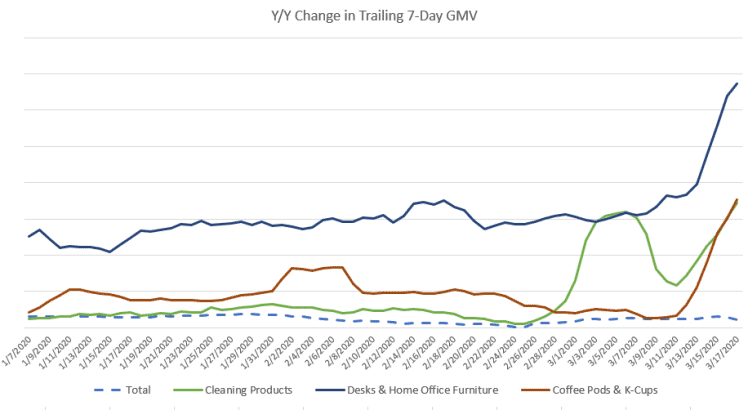

Online sales – Home

Aspects of home furnishing are up. Shoppers may have prioritized creating a better at-home workplace environment first, and are now shifting attention to other areas of the home. Garden furniture tends to get a lot of searches on the weekends but has demand has been rapidly growing since more severe social distancing measures were put in place across the U.S. last week.

-

Hyperlocal

One of the most important segments that is making a difference in today’s times, the segment has turned out to be a lifeline for many. The players in the segment included everyone from supplying groceries and other household essentials, food delivery from your favorite restaurant to delivering documents, these players are effectively front line workers in helping individuals cope and combat this virus and keeping the wheels moving. It is crucial that companies in the segment take all necessary precautions. Grocery is one very obvious example.

While the government is making commendable efforts to contain the threat, they (at the state and center level) need to work in tandem with eCommerce companies in their efforts to provide much-needed goods and services to millions of customers. Their support and boost to the sector will also allow the “food-chain” to survive – everyone from MSMEs, small business owners, and entrepreneurs will be able to wade this high tide. The government has already issued an exempt status to eCommerce companies’ classifying it as an essential service, and it is imperative that the segment is enabled to accelerate helping on the frontlines.

Search Terms That Are Declining

-

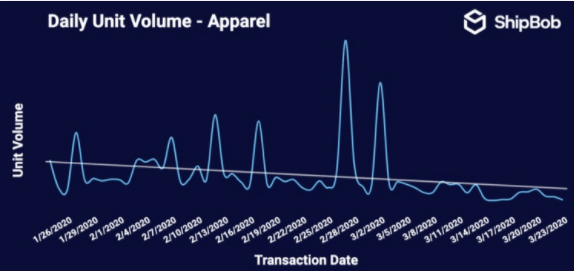

Fashion & Apparel

Fashion retailers have lost a lot of visitors at the moment. After all, who’s buying a new outfit just to stay in the house? It’s not just high street retailers that are suffering, eCommerce biggies are also seeing a dip due to COVID-19.

-

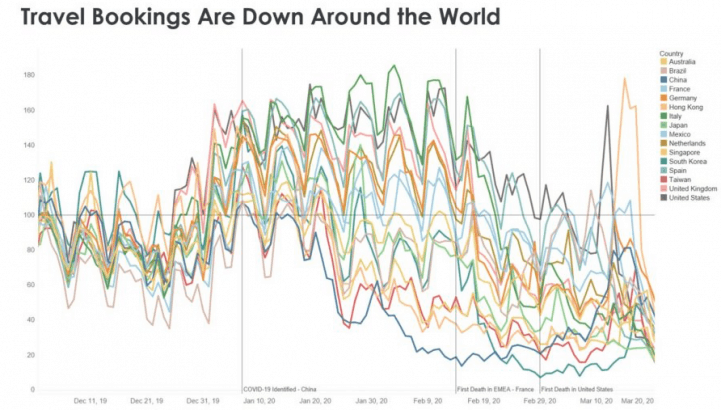

Travel

The segment has hit a road bump, considering the drastic decline is transport requirements as most individuals are stuck in their couches rather than in the backseat of a car, Travel has understandably nosedived. However, there is little doubt that once the situation normalizes, the segment is going to bounce back to pre-COVID times. Traffic to lots of travel sites is ironically up, but most of it related to customer service requests or cancellations.

-

Luxury Goods

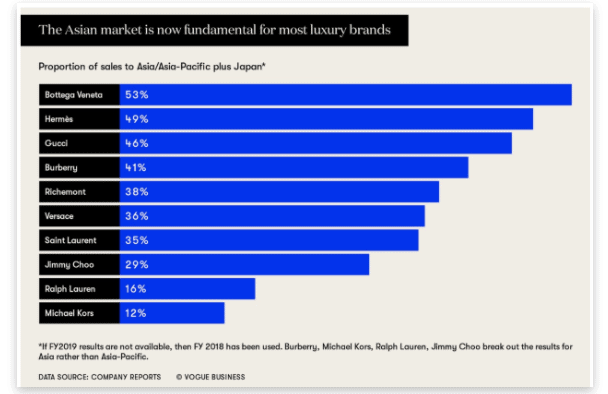

While the above products and services are increasing in sales due to the current situation, other industries are not doing as well. In addition to obvious ones like entertainment, restaurants, and travel, one area projected to have significant losses is the luxury goods industry.

Vogue Business projects a potential loss as great as $10 billion for this industry in 2020 due to COVID-19. This is in part because luxury goods rely heavily on the Asian market’s purchasing power, where the pandemic has been affecting consumers since January.

This chart from Vogue Business illustrates the importance of Asian buyers for top luxury brands:

Conclusion

Be proactive, not reactive! – We are, all of us, currently living in flux.

Your customers are trying their best to adapt to strange times without a lot of footholds and shifting their behavior as a result. As a business owner, you are facing much of the same uncertainty, while trying to support your customers’ needs and your own

Officially the world’s largest retailer, Amazon has announced it can not continue with consumer demand. As a result, it’ll be delaying the delivery of non-essential items, or in some cases not taking orders for non-essentials in the least.

Meanwhile, the question remains: will this drastic change in consumer behavior stabilize once we flatten the curve, or is that this our new normal?

In the interim, brands that don’t fit into those immediate needs discussed above may need to alter the way they communicate value propositions to their customers and look for opportunities to capitalize on changing consumer preferences.

Until then stay healthy, and use this period to your advantage to consider how you can improve your operations for the future.